✓ What Is Account Receivable

- Dapatkan link

- X

- Aplikasi Lainnya

✓ What Is Account Receivable. Accounts receivable (ar) are funds the company expects to receive from customers and partners. Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected.

Accounts receivable is a current asset account that keeps track of money that third parties owe to you. $60,000 / $2,000 = 30. Accounts receivable (often abbreviated ar or a/r) is an accounting term that refers to any of the following. Credit #3000 accounts receivable $2,000 (increase) (to recognize bad debt expense) the allowance for doubtful accounts is a more complex method used to post bad. Accounts receivable (ar) is the proceeds or payment which the company will receive from its customers who have purchased its goods & services on credit.

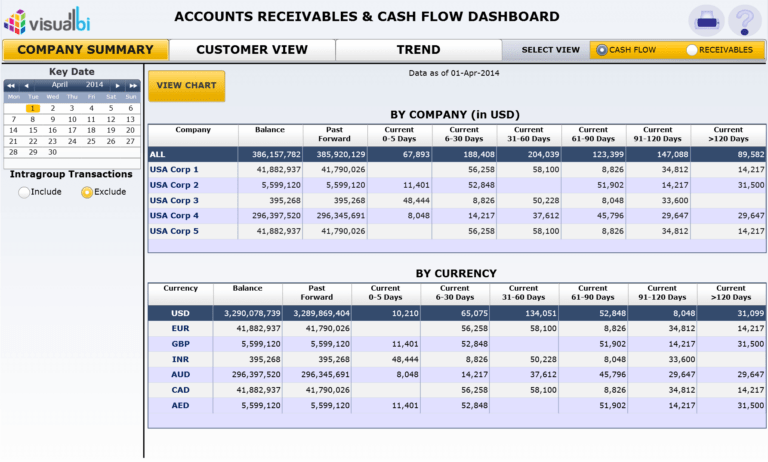

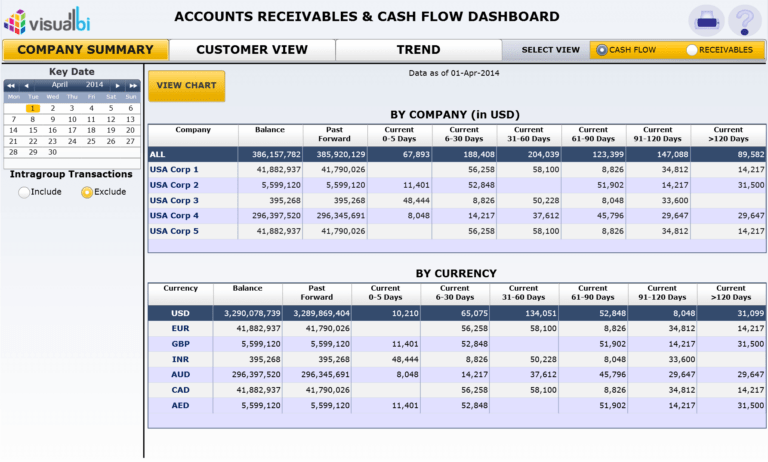

Account Receivables & Collection Analysis Excel Spreadsheet with regard

Account Receivables & Collection Analysis Excel Spreadsheet with regard from db-excel.com. This unpaid invoice describes the sale of. Accounts receivable (ar) is the proceeds or payment which the company will receive from its customers who have purchased its goods & services on credit. Accounts receivables are created when a company lets a buyer purchase their goods or services on credit.

Accounts receivable is the name given to both the money that’s owed, and the process of collecting it. Accounts receivable is a current resource account, which speaks to the cash to be gotten by the organization, against the products delivered or services delivered to the clients. Credit #3000 accounts receivable $2,000 (increase) (to recognize bad debt expense) the allowance for doubtful accounts is a more complex method used to post bad. The accounts receivable aging report itemizes all receivables in the accounting system, so its total should match the ending balance in the accounts receivable general ledger. $60,000 / $2,000 = 30.

Here are the steps of the accounts receivable process: Again, these third parties can be banks, companies, or even people who. The accounts receivable process enables a business to track its incoming funds. Accounts receivable is a current resource account, which speaks to the cash to be gotten by the organization, against the products delivered or services delivered to the clients. Money that is expected from.

Accounting basics WikiEducator

Accounting basics WikiEducator from wikieducator.org. Ar is listed as a current asset on the balance sheet. Money that is expected from. So the accounts receivable process includes things like sending invoices,.

This unpaid invoice describes the sale of. Accounts receivable are documented through outstanding invoices, which you, as seller, are responsible for issuing to the customer. The point of the measurement is to determine the. Accounts receivable (ar) is the proceeds or payment which the company will receive from its customers who have purchased its goods & services on credit. Here are the steps of the accounts receivable process:

This unpaid invoice describes the sale of. Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected. Accounts receivable is the dollar amount of credit sales that are not collected in cash. Credit #3000 accounts receivable $2,000 (increase) (to recognize bad debt expense) the allowance for doubtful accounts is a more complex method used to post bad. The accounts receivable process enables a business to track its incoming funds.

Accounts receivable (ar) is the proceeds or payment which the company will receive from its customers who have purchased its goods & services on credit. An account receivable is an asset recorded on the balance sheet as a result of an unpaid sale transaction, explains bdc advisory services senior business advisor nicolas fontaine. Accounts receivable (ar) are funds the company expects to receive from customers and partners.

Credit #3000 accounts receivable $2,000 (increase) (to recognize bad debt expense) the allowance for doubtful accounts is a more complex method used to post bad. ✓ What Is Account Receivable. Credit #3000 accounts receivable $2,000 (increase) (to recognize bad debt expense) the allowance for doubtful accounts is a more complex method used to post bad. Here are the steps of the accounts receivable process: Accounts receivable is the dollar amount of credit sales that are not collected in cash.

✓ What Is Account Receivable

An account receivable is an asset recorded on the balance sheet as a result of an unpaid sale transaction, explains bdc advisory services senior business advisor nicolas fontaine. The point of the measurement is to determine the. There are two primary types of assets a company.

Accounts receivable are documented through outstanding invoices, which you, as seller, are responsible for issuing to the customer. Accounts receivable is a current resource account, which speaks to the cash to be gotten by the organization, against the products delivered or services delivered to the clients. Accounts receivable (ar) are funds the company expects to receive from customers and partners.

Accounts receivable is the name given to both the money that’s owed, and the process of collecting it. Ar is listed as a current asset on the balance sheet. Accounts receivable is the dollar amount of credit sales that are not collected in cash.

Money that is expected from. There are two primary types of assets a company. Accounts receivables are created when a company lets a buyer purchase their goods or services on credit.

![Accounts Executive Resume Sample [2020] MaxResumes](https://i2.wp.com/maxresumes.com/wp-content/uploads/edd/2020/08/accounts-executive-resume-example-723x1024.jpg)

Accounts receivable are documented through outstanding invoices, which you, as seller, are responsible for issuing to the customer. Accounts payable is similar to accounts receivable, but. Accounts receivable is a current resource account, which speaks to the cash to be gotten by the organization, against the products delivered or services delivered to the clients.

Accounts receivable are documented through outstanding invoices, which you, as seller, are responsible for issuing to the customer. Accounts receivable is the dollar amount of credit sales that are not collected in cash. Accounts receivable (ar) is simply the amount of cash your customers haven’t paid yet from past purchases.

Usually the credit period is. This unpaid invoice describes the sale of. Ar is listed as a current asset on the balance sheet.

Accounts receivable (often abbreviated ar or a/r) is an accounting term that refers to any of the following. Accounts receivable is an asset because it denotes money the company expects to receive from its clients or customers. Ar is listed as a current asset on the balance sheet.

Accounts receivable (ar) is simply the amount of cash your customers haven’t paid yet from past purchases. The accounts receivable aging report itemizes all receivables in the accounting system, so its total should match the ending balance in the accounts receivable general ledger. Receivables is an asset designation applicable to all debts, unsettled transactions or other monetary obligations owed to a company by its debtors or customers.

The Accounts Receivable Aging Report Itemizes All Receivables In The Accounting System, So Its Total Should Match The Ending Balance In The Accounts Receivable General Ledger.

Here are the steps of the accounts receivable process: Accounts receivable is the dollar amount of credit sales that are not collected in cash. An account receivable is an asset recorded on the balance sheet as a result of an unpaid sale transaction, explains bdc advisory services senior business advisor nicolas fontaine.. ✓ What Is Account Receivable

The Amount Of Money Owed To A Company For Products Or Services Provided Or Utilized But Not Yet Paid For By Consumers Is Known As Accounts.

Accounts receivable (ar) represents the credit sales of a business, which have not yet been collected from its customers. So the accounts receivable process includes things like sending invoices,. Accounts receivable are documented through outstanding invoices, which you, as seller, are responsible for issuing to the customer.. ✓ What Is Account Receivable

The Accounts Receivable Turnover Ratio Is An Important Financial Ratio That Measures How Quickly And Efficiently A Company Collects Its Receivables.

When you sell on credit, you give the customer an invoice and don’t collect cash at the. Accounts payable is similar to accounts receivable, but. The point of the measurement is to determine the.. ✓ What Is Account Receivable

Accounts Receivable (Often Abbreviated Ar Or A/R) Is An Accounting Term That Refers To Any Of The Following.

Accounts receivable (ar) are funds the company expects to receive from customers and partners. Companies allow their clients to pay for goods and. The accounts receivable process enables a business to track its incoming funds.. ✓ What Is Account Receivable

Key Takeaways Accounts Receivable Is An Asset Account On The Balance Sheet That Represents Money Due To A Company In The Short Term.

Accounts receivables are created when a company lets a buyer purchase their goods or services on credit. Ar is listed as a current asset on the balance sheet. Usually the credit period is.. ✓ What Is Account Receivable

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar