✓ Brokerage Account Vs Roth Ira

- Dapatkan link

- X

- Aplikasi Lainnya

✓ Brokerage Account Vs Roth Ira. You may wonder about the distinction between an ira and a brokerage account. In short, though, you can’t really compare them, since a roth ira is a retirement account, while at brokerage account can hold almost anything.

They are referred to as “taxable accounts” because you don’t get the tax. When comparing the traditional ira vs. When you are ready to retire, roth iras have no minimum distributions. As long as you meet the requirements of the roth ira, any. Here are some of the main differences between the two.

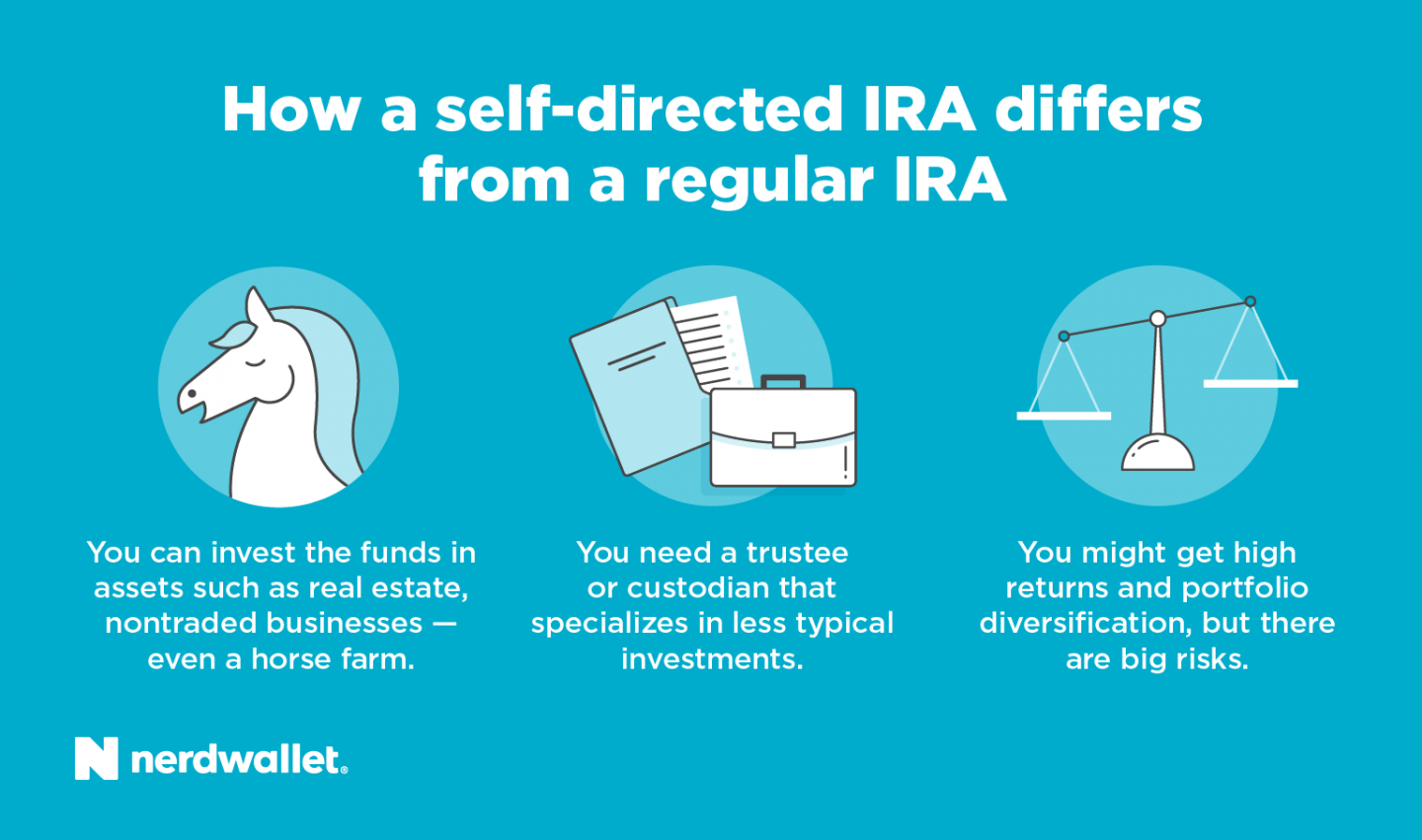

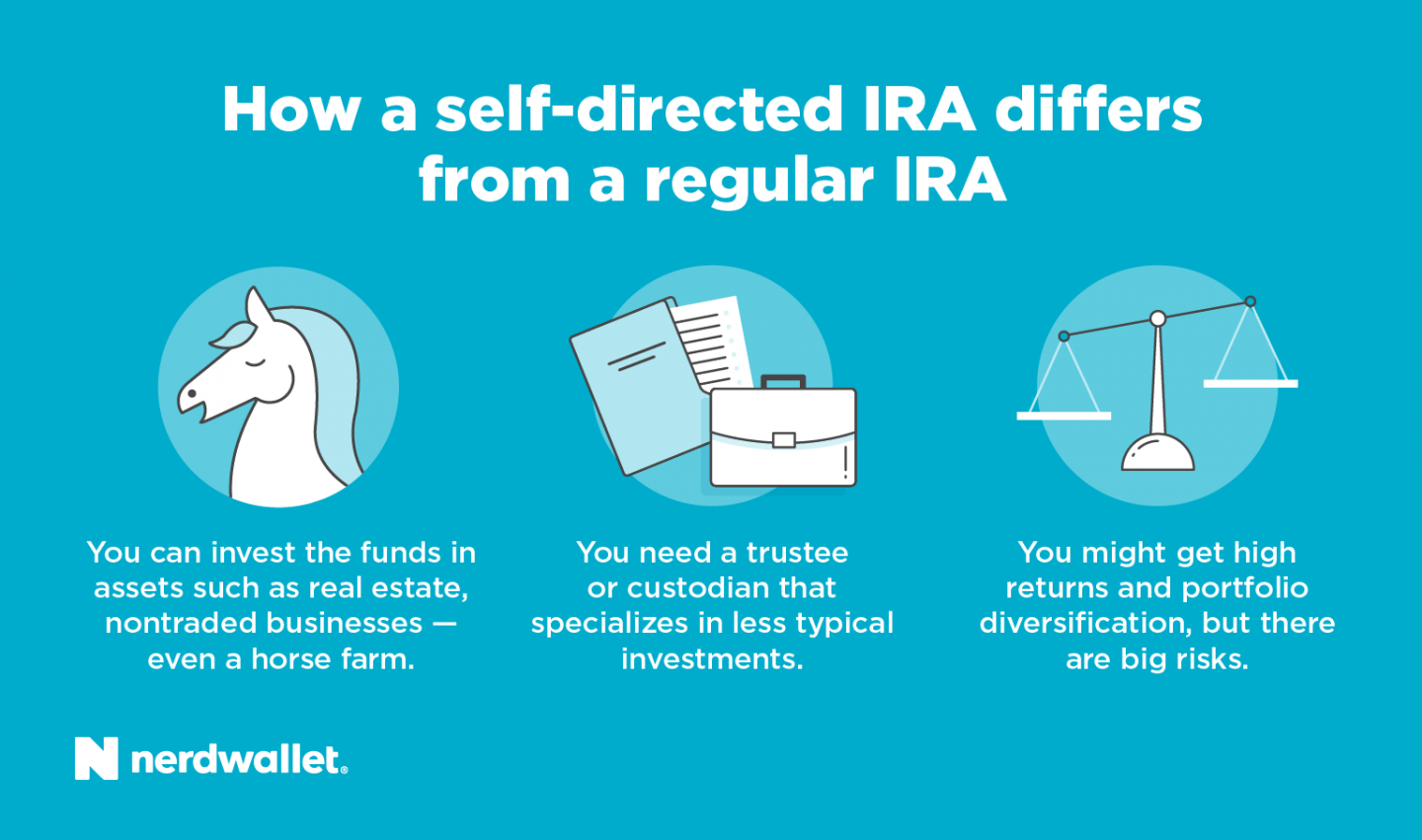

SelfDirected IRAs An Option for Expert Investors NerdWallet

SelfDirected IRAs An Option for Expert Investors NerdWallet from www.nerdwallet.com. As offered by the plan. Many as long as not prohibited. Roth iras are great vehicles for saving.

Roth ira vs brokerage account. Starting a brokerage account grants you access to the stock market, mutual funds, and other securities. As long as you meet the requirements of the roth ira, any. A brokerage account allows you to buy and sell different assets on a rolling basis, though you may earn interest on uninvested cash. In 2021, the contribution cap is $6,000 per year per person or $7,000 if you are 50 or older.

An essential distinction between brokerage accounts and iras is that brokerage accounts are taxable. You may wonder about the distinction between an ira and a brokerage account. First, there’s a limit to how much you can invest: Starting a savings account & traditional ira vs. As offered by the plan.

Election Results and Market Impact FAQs Charles Schwab

Election Results and Market Impact FAQs Charles Schwab from www.schwab.com. Here are some of the main differences between the two. The benefit is that you don't pay taxes on your withdrawals, so the money grows. And with a roth ira, it’s important to consider.

As offered by the plan. They are referred to as “taxable accounts” because you don’t get the tax. Everything inside of that account. In 2021, the contribution cap is $6,000 per year per person or $7,000 if you are 50 or older. With what’s leftover (up to $6,000/year) you can contribute to a roth ira.

Many as long as not prohibited. Everything inside of that account. When you are ready to retire, roth iras have no minimum distributions. Second, you can only make full contributions to these. Here’s how taxes work in a roth ira:

The benefit is that you don't pay taxes on your withdrawals, so the money grows. An essential distinction between brokerage accounts and iras is that brokerage accounts are taxable. When comparing the traditional ira vs.

Brokerage accounts and iras are investment accounts that allow you to buy and sell stocks, etfs, bonds, mutual funds, real. ✓ Brokerage Account Vs Roth Ira. As offered by the plan. Even better, the earnings are not taxed as. The benefit is that you don't pay taxes on your withdrawals, so the money grows.

✓ Brokerage Account Vs Roth Ira

In 2021, the contribution cap is $6,000 per year per person or $7,000 if you are 50 or older. That means you can withdraw as much as you want when you want it. Roth iras are great vehicles for saving.

As offered by the plan. Starting a brokerage account grants you access to the stock market, mutual funds, and other securities. Roth individual retirement accounts (roth iras) allow you to contribute.

Brokerage accounts and iras are investment accounts that allow you to buy and sell stocks, etfs, bonds, mutual funds, real. Second, you can only make full contributions to these. A brokerage account allows you to buy and sell different assets on a rolling basis, though you may earn interest on uninvested cash.

Roth ira vs brokerage account. Second, you can only make full contributions to these. Even better, the earnings are not taxed as.

That means you can withdraw as much as you want when you want it. First, there’s a limit to how much you can invest: How to know when to use a taxable account vs ira.

Participant in a 401, 403 or 457 governmental. Brokerage accounts and iras are investment accounts that allow you to buy and sell stocks, etfs, bonds, mutual funds, real. Roth ira vs brokerage account.

With what’s leftover (up to $6,000/year) you can contribute to a roth ira. Example, i hold my roth ira in my brokerage. How to know when to use a taxable account vs ira.

In Short, Though, You Can’t Really Compare Them, Since A Roth Ira Is A Retirement Account, While At Brokerage Account Can Hold Almost Anything.

Participant in a 401, 403 or 457 governmental. Both regular brokerage accounts and iras allow you to buy stocks, bonds. As long as you meet the requirements of the roth ira, any.. ✓ Brokerage Account Vs Roth Ira

You May Wonder About The Distinction Between An Ira And A Brokerage Account.

Roth iras are retirement accounts that give investors valuable tax benefits. Starting a savings account & traditional ira vs. You get paid and pay income tax.. ✓ Brokerage Account Vs Roth Ira

Roth Iras Are Great Vehicles For Saving.

As offered by the plan. Brokerage accounts and individual retirement accounts (iras) offer two very different ways to invest. With what’s leftover (up to $6,000/year) you can contribute to a roth ira.. ✓ Brokerage Account Vs Roth Ira

A Brokerage Account Allows You To Buy And Sell Different Assets On A Rolling Basis, Though You May Earn Interest On Uninvested Cash.

Here’s how taxes work in a roth ira: Here are some of the main differences between the two. The account holder is 59 1/2 years of age or more when the distribution occurs.. ✓ Brokerage Account Vs Roth Ira

As Opposed To A Brokerage Account, The Amount Of Funds You Can Pay Into An Ira Is Limited By The Irs.

Roth individual retirement accounts (roth iras) allow you to contribute. Brokerage accounts and iras are investment accounts that allow you to buy and sell stocks, etfs, bonds, mutual funds, real. Many as long as not prohibited.. ✓ Brokerage Account Vs Roth Ira

:max_bytes(150000):strip_icc()/iras-5bfc31f246e0fb0051bf0553.jpg)

Komentar

Posting Komentar