★ Accounts Receivable Turnover Formula

- Dapatkan link

- X

- Aplikasi Lainnya

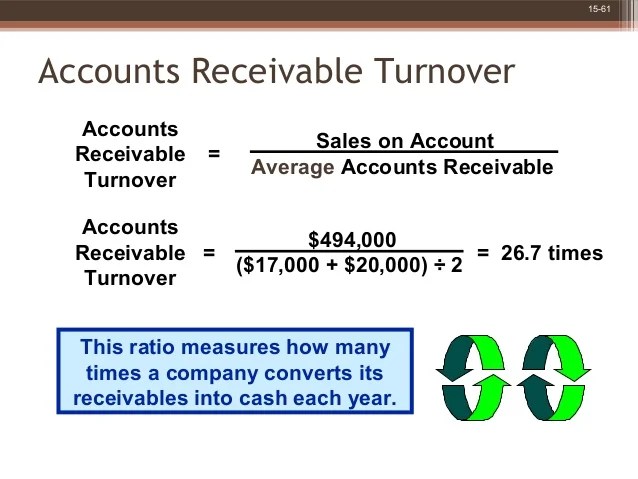

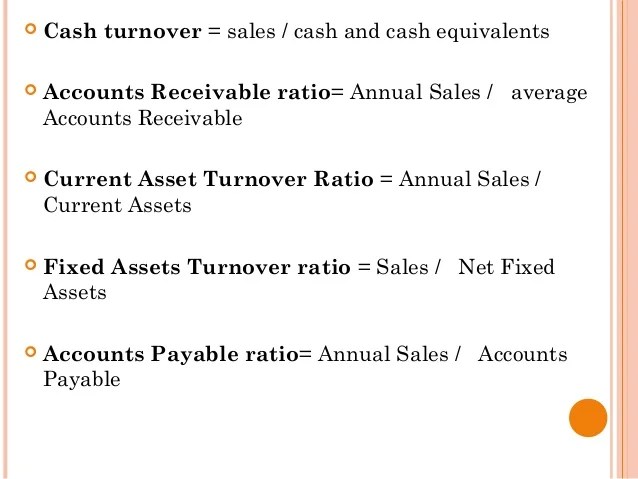

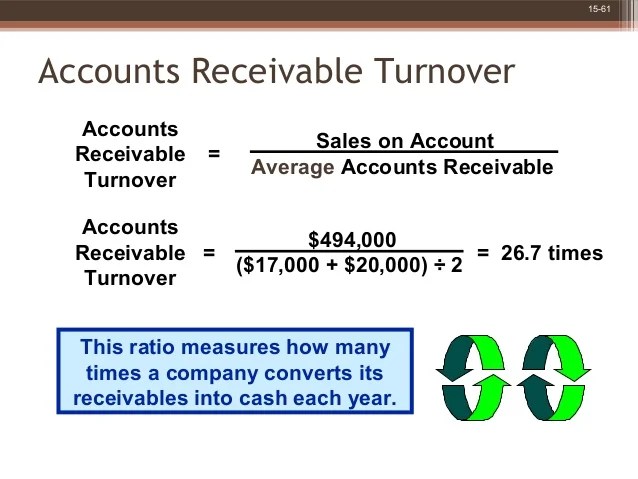

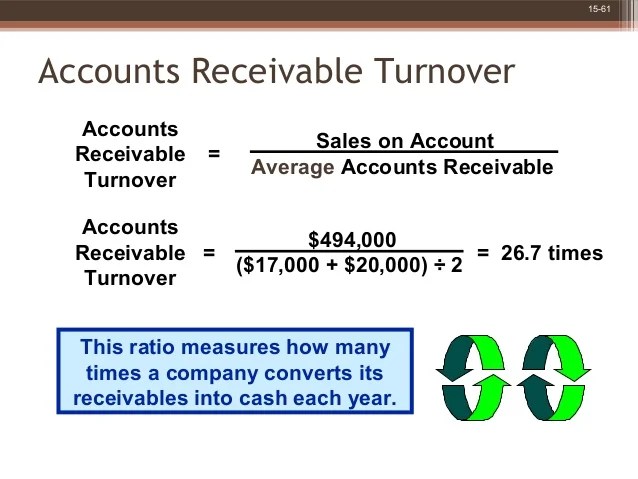

★ Accounts Receivable Turnover Formula. 365 / accounts receivables turnover ratio = accounts receivables turnover ratio in days Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable.

Through these formulas, both companies are able to get a better understanding of how well they are doing with collecting on debts owed to their business. Its submitted by giving out in the best field. In financial modeling, the accounts receivable turnover ratio is used to make balance sheet forecasts. Learn more about what an ar turnover ratio is and how to calculate this bookkeeping metric. Company a reported annual purchases on credit of $123,555 and returns of $10,000 during the year ended december 31, 2017.

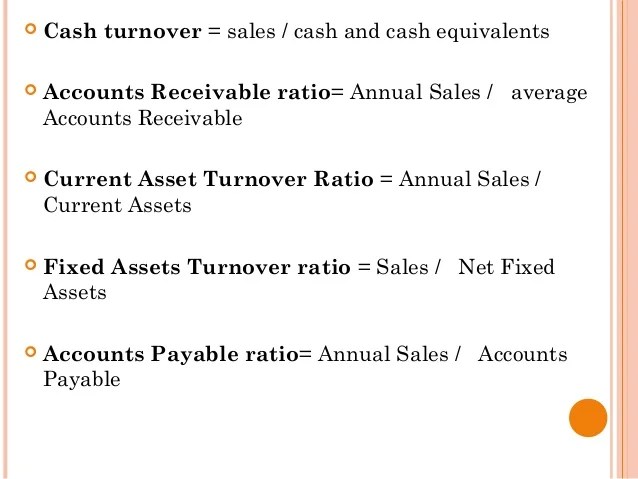

Ratio analysis1

Ratio analysis1 from www.slideshare.net. The accounts receivable turnover is calculated by dividing the net credit sales by the average accounts receivable accounts receivable accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. To determine how much revenue your company earns from all its credit sales, subtract the total value in returns from all sales on credit. If we want to extract useful information out of this, we have to calculate the accounts receivable turnover in days according to this formula:

The formula is as follows: Next, divide the average receivables balance by net credit sales during the. First, use a company’s balance sheet to calculate average receivables during the period: Find the total amount in credit sales. Calculate the trade receivables turnover ratio using the following formula:

Accounts receivable turnover is one of the most used efficiency ratios and activities ratios. The accounts receivable turnover ratio measures the efficiency at which a company can collect its outstanding receivables from customers. The a/r turnover ratio is calculated using data found on a company’s income statement and balance sheet. Furthermore, you can find the “troubleshooting login issues” section which can answer your. Net annual credit sales ÷ ( (beginning accounts receivable + ending accounts receivable) / 2)

manpreet fianacial statement analysis

manpreet fianacial statement analysis from www.slideshare.net. The formula is as follows: You can calculate the average receivables with the formula: The first thing we need to do in order to calculate bill’s turnover is to calculate net credit sales and average accounts receivable.

Average accounts receivable can be calculated by averaging beginning and ending accounts receivable balances ( (10,000. First, use a company’s balance sheet to calculate average receivables during the period: Find the total amount in credit sales. To determine the average number of days it took to get invoices paid, you must divide the number of days per year, 365, by the accounts receivable turnover ratio of 11.4. In other words, it determines how efficiently a company uses its assets by using data from its net credit sales and average accounts receivable.

[average accounts receivable = (starting balance + ending balance) / 2] 2. Written by the masterclass staff. The accounts receivable turnover is calculated by dividing the net credit sales by the average accounts receivable accounts receivable accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. Loginask is here to help you access accounts receivable turnover ratio formula quickly and handle each specific case you encounter. Furthermore, you can find the “troubleshooting login issues” section which can answer your.

[average accounts receivable = (starting balance + ending balance) / 2] 2. To determine how much revenue your company earns from all its credit sales, subtract the total value in returns from all sales on credit. Loginask is here to help you access accounts receivable turnover ratio formula quickly and handle each specific case you encounter.

Through these formulas, both companies are able to get a better understanding of how well they are doing with collecting on debts owed to their business. ★ Accounts Receivable Turnover Formula. Company a reported annual purchases on credit of $123,555 and returns of $10,000 during the year ended december 31, 2017. The a/r turnover ratio is calculated using data found on a company’s income statement and balance sheet. You can calculate the average receivables with the formula:

★ Accounts Receivable Turnover Formula

Through these formulas, both companies are able to get a better understanding of how well they are doing with collecting on debts owed to their business. Calculate the trade receivables turnover ratio using the following formula: Now we can apply these values to our formula:

Accounts receivables turnover ratio formula examples of accounts receivables turnover ratio formula. The company wants to measure how many times it paid its creditors over the. Through these formulas, both companies are able to get a better understanding of how well they are doing with collecting on debts owed to their business.

[average accounts receivable = (starting balance + ending balance) / 2] 2. One way for a company to boost revenue on its balance sheet is to improve its accounts receivable turnover ratio. In this situation, the receivables turnover would be 2.33.

Next, divide the average receivables balance by net credit sales during the. Learn more about what an ar turnover ratio is and how to calculate this bookkeeping metric. To determine the average number of days it took to get invoices paid, you must divide the number of days per year, 365, by the accounts receivable turnover ratio of 11.4.

Its submitted by giving out in the best field. Accounts receivables turnover ratio formula examples of accounts receivables turnover ratio formula. It is the revenue sales generated by a company by allowing the extension of credit to.

In financial modeling, the accounts receivable turnover ratio is used to make balance sheet forecasts. First, use a company’s balance sheet to calculate average receivables during the period: Find the total amount in credit sales.

Accounts receivable turnover ratio use. In this situation, the receivables turnover would be 2.33. Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable.

The formula is as follows: In this situation, the receivables turnover would be 2.33. Through these formulas, both companies are able to get a better understanding of how well they are doing with collecting on debts owed to their business.

Through these formulas, both companies are able to get a better understanding of how well they are doing with collecting on debts owed to their business. This ratio is used to measure how efficiently the company’s assets and resources are managed and used. Now we can apply these values to our formula:

Let Us Understand The Accounts Receivables Turnover Ratio With The Help Of This Example:

Accounts receivable turnover is one of the most used efficiency ratios and activities ratios. The first thing we need to do in order to calculate bill’s turnover is to calculate net credit sales and average accounts receivable. In this situation, the receivables turnover would be 2.33.. ★ Accounts Receivable Turnover Formula

There Is A Sales Return Of Rs.

To determine how much revenue your company earns from all its credit sales, subtract the total value in returns from all sales on credit. First, use a company’s balance sheet to calculate average receivables during the period: The a/r turnover ratio is calculated using data found on a company’s income statement and balance sheet.. ★ Accounts Receivable Turnover Formula

Through These Formulas, Both Companies Are Able To Get A Better Understanding Of How Well They Are Doing With Collecting On Debts Owed To Their Business.

For example, how well the company turns its accounts receivable into cash? Net annual credit sales ÷ ( (beginning accounts receivable + ending accounts receivable) / 2) Accounts receivable turnover ratio use.. ★ Accounts Receivable Turnover Formula

Feb 25, 2022 • 4 Min Read.

Learn more about what an ar turnover ratio is and how to calculate this bookkeeping metric. Here are a number of highest rated accounts receivable turnover ratio use pictures upon internet. If we want to extract useful information out of this, we have to calculate the accounts receivable turnover in days according to this formula:. ★ Accounts Receivable Turnover Formula

It Is The Revenue Sales Generated By A Company By Allowing The Extension Of Credit To.

Written by the masterclass staff. We take on this kind of accounts receivable turnover ratio use graphic. Next, divide the average receivables balance by net credit sales during the.. ★ Accounts Receivable Turnover Formula

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar