✓ Coverdell Education Savings Accounts

- Dapatkan link

- X

- Aplikasi Lainnya

✓ Coverdell Education Savings Accounts. Rules for coverdell education savings accounts (education iras) your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to. Contributions to coverdell accounts can total.

There are certain requirements to set up a coverdell esa: The account must be started before the child beneficiary reaches the. Contributions to coverdell accounts can total. A coverdell esa can be used for education expenses such as tuition, books, room and board, computers, peripherals, software and internet access for kindergarten through high school,. The cesa cannot be deducted.

Main Branch University Credit Union Branches & ATMs

Main Branch University Credit Union Branches & ATMs from www.ucu.org. A coverdell education savings account is a special account that can be used to save, invest and pay for a child’s education with tax advantages. You can contribute to the account as long as the beneficiary is under 18 years old. A coverdell esa can be used for education expenses such as tuition, books, room and board, computers, peripherals, software and internet access for kindergarten through high school,.

Coverdell education savings accounts offer tax incentives to save for future costs of school. A coverdell education savings account is a special account that can be used to save, invest and pay for a child’s education with tax advantages. A coverdell esa can be used for education expenses such as tuition, books, computers, software, peripherals, internet access,. The cesa cannot be deducted. Just like a 529 savings plan, a coverdell esa.

Annual contributions are capped at $2,000 for joint filers with a modified adjusted gross. Rules for coverdell education savings accounts (education iras) your gross annual income must be below $110,000 for an individual or $220,000 for a married couple to. To use a coverdell education savings account, a child must be 15 years old and enrolled in school in order for tax advantages to be applied. The account must be started before the child beneficiary reaches the. A coverdell esa can be used for education expenses such as tuition, books, room and board, computers, peripherals, software and internet access for kindergarten through high school,.

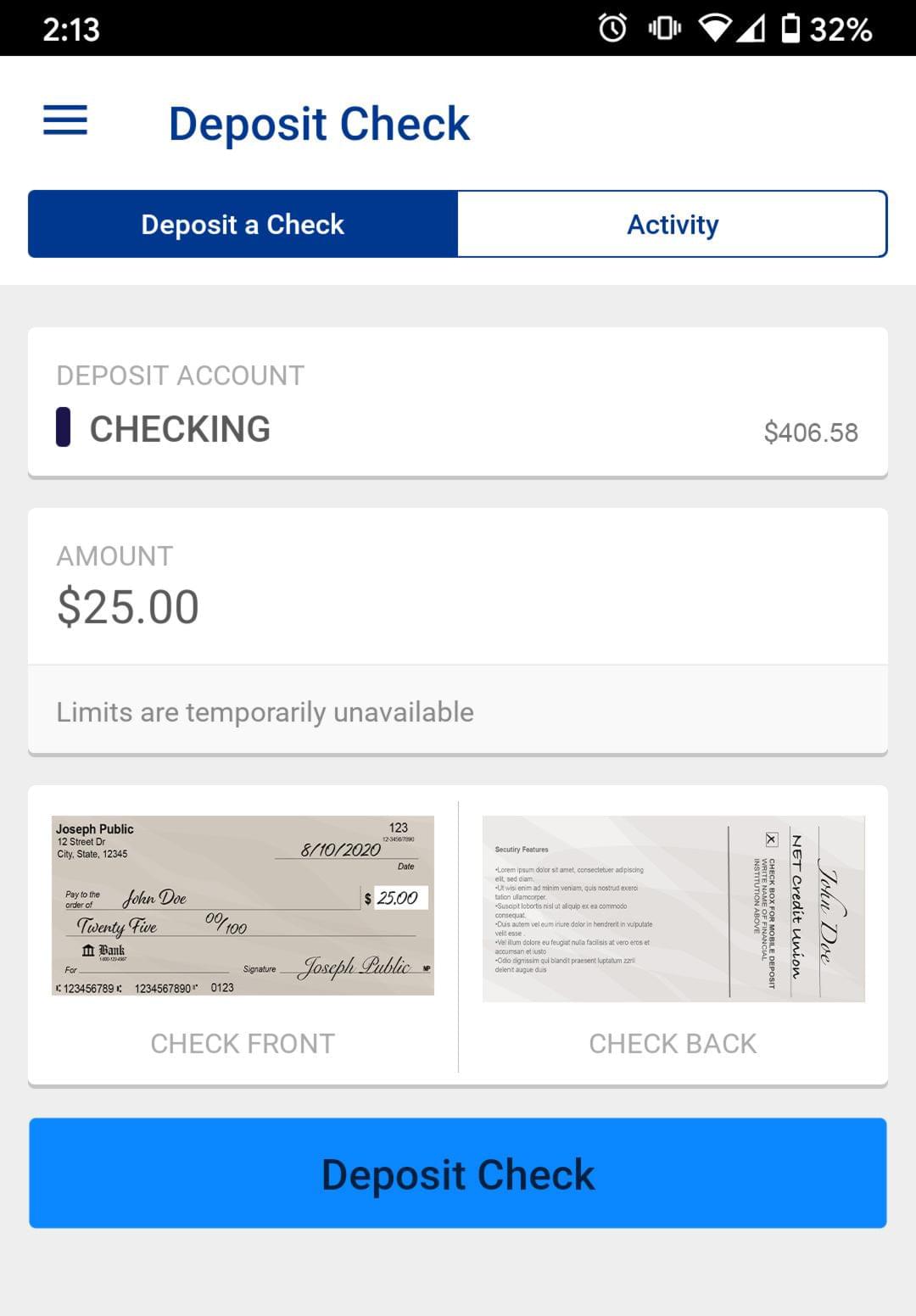

Keeping a close eye on your accounts? NET Credit Union

Keeping a close eye on your accounts? NET Credit Union from www.netcreditunion.com. Annual contributions are capped at $2,000 for joint filers with a modified adjusted gross. Contributions to coverdell accounts can total. Learn how a coverdell esa works and how it.

A coverdell education savings account is a special account that can be used to save, invest and pay for a child’s education with tax advantages. Government to assist families in. More precisely, coverdell esas are trusts or custodial. However, coverdell esas have a broader list of qualified expenses than. The coverdell esa is a savings plan created for the purpose of paying a student's qualified educational expenses.

Contributions to coverdell accounts can total. To use a coverdell education savings account, a child must be 15 years old and enrolled in school in order for tax advantages to be applied. A coverdell education savings account (also known as an education savings account, a coverdell esa, a coverdell account, or just an esa, and formerly known as an education. A coverdell education savings account (esa) is a trust or custodial account designed to help families pay for education. There are certain requirements to set up a coverdell esa:

The account must be started before the child beneficiary reaches the. A coverdell education savings account is a special account that can be used to save, invest and pay for a child’s education with tax advantages. The coverdell esa is a savings plan created for the purpose of paying a student's qualified educational expenses.

More precisely, coverdell esas are trusts or custodial. ✓ Coverdell Education Savings Accounts. Contributions to coverdell accounts can total. More precisely, coverdell esas are trusts or custodial. A coverdell esa can be used for education expenses such as tuition, books, computers, software, peripherals, internet access,.

✓ Coverdell Education Savings Accounts

A coverdell education savings account (also known as an education savings account, a coverdell esa, a coverdell account, or just an esa, and formerly known as an education. The table below shows how coverdell education savings accounts compare to 529 plans. The coverdell esa is a savings plan created for the purpose of paying a student's qualified educational expenses.

There are certain requirements to set up a coverdell esa: Contributions to coverdell accounts can total. A coverdell education savings account (also known as an education savings account, a coverdell esa, a coverdell account, or just an esa, and formerly known as an education.

Coverdell education savings accounts offer tax incentives to save for future costs of school. Contributions to a cesa are not tax deductible,. These can include, but are not.

A coverdell education savings account is an investment vehicle that lets you save toward a student's education expenses. You can contribute to the account as long as the beneficiary is under 18 years old. The cesa cannot be deducted.

A coverdell esa can be used for education expenses such as tuition, books, computers, software, peripherals, internet access,. There are certain requirements to set up a coverdell esa: Contributions to coverdell accounts can total.

Coverdell education savings accounts offer tax incentives to save for future costs of school. A coverdell esa can be used for education expenses such as tuition, books, room and board, computers, peripherals, software and internet access for kindergarten through high school,. The cesa cannot be deducted.

The coverdell esa is a savings plan created for the purpose of paying a student's qualified educational expenses. Contributions to a cesa are not tax deductible,. These can include, but are not.

The Account Must Be Started Before The Child Beneficiary Reaches The.

The coverdell esa is a savings plan created for the purpose of paying a student's qualified educational expenses. A coverdell education savings account (also known as an education savings account, a coverdell esa, a coverdell account, or just an esa, and formerly known as an education. More precisely, coverdell esas are trusts or custodial.. ✓ Coverdell Education Savings Accounts

Learn How A Coverdell Esa Works And How It.

Annual contributions are capped at $2,000 for joint filers with a modified adjusted gross. Government to assist families in. A coverdell education savings account is an investment vehicle that lets you save toward a student's education expenses.. ✓ Coverdell Education Savings Accounts

The Cesa Cannot Be Deducted.

These can include, but are not. However, coverdell esas have a broader list of qualified expenses than. There are certain requirements to set up a coverdell esa:. ✓ Coverdell Education Savings Accounts

A Coverdell Education Savings Account (Esa) Is A Trust Or Custodial Account Designed To Help Families Pay For Education.

Coverdell education savings accounts offer tax incentives to save for future costs of school. A coverdell esa can be used for education expenses such as tuition, books, computers, software, peripherals, internet access,. To use a coverdell education savings account, a child must be 15 years old and enrolled in school in order for tax advantages to be applied.. ✓ Coverdell Education Savings Accounts

Rules For Coverdell Education Savings Accounts (Education Iras) Your Gross Annual Income Must Be Below $110,000 For An Individual Or $220,000 For A Married Couple To.

A coverdell esa can be used for education expenses such as tuition, books, room and board, computers, peripherals, software and internet access for kindergarten through high school,. A coverdell education savings account is a special account that can be used to save, invest and pay for a child’s education with tax advantages. You can contribute to the account as long as the beneficiary is under 18 years old.. ✓ Coverdell Education Savings Accounts

Komentar

Posting Komentar