✓ Mark To Market Accounting

- Dapatkan link

- X

- Aplikasi Lainnya

✓ Mark To Market Accounting. However, it can also be used for assets that are not associated with high degrees of fluctuation, such as business inventory and real estate. What is mark to market accounting method?

It has 3 major types, i.e., transaction entry, adjusting entry, & closing entry. Margin accounts are calculated using mark to the market accounting. The mark to market accounting journal entries accounting journal entries accounting entry is a summary of all the business transactions in the accounting books, including the debit & credit entry. However, it can also be used for assets that are not associated with high degrees of fluctuation, such as business inventory and real estate. What is mark to market accounting method?

from venturebeat.com. The mark to market accounting journal entries accounting journal entries accounting entry is a summary of all the business transactions in the accounting books, including the debit & credit entry. But the valuation being volatile in nature can influence the investor at a higher level. Report sales from investments on schedule d, not form 4797.

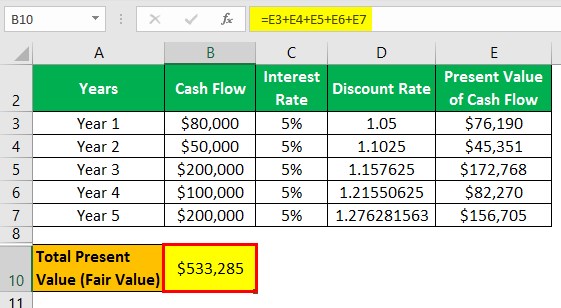

It estimates how much an asset might sell for if the owner sells it today. In that case, the trader taking a long position. The marketwatch news department was not involved in the creation of this content. All mark to market does is simply align the value of assets to the value that it would acquire in the present conditions of the market. Mark to market accounting was an alternative to the popular historical cost accounting methodology, where an asset’s cost was evaluated based on its original price.

Used to evaluate the fair market value of. The instructions for form 4797 state: The market value is based on what a company could receive for the asset if it was sold at that point in time. Under mtm accounting, assets can be recorded on a company’s balance sheet at their fair market value (as opposed to their book values). Mark to market (mtm) is a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities.

from venturebeat.com. This type of accounting is mainly used for securities and derivatives. But the valuation being volatile in nature can influence the investor at a higher level. Of course, the origins of this value stems from the capital a company would gain if they sold that asset right there and then.

What is mark to market accounting method? Banks (and brokerage firms) that own mortgage backed securities have been required — since november 2007 — to use mark to market accounting on these securities. The instructions for form 4797 state: Under mtm accounting, assets can be recorded on a company’s balance sheet at their fair market value (as opposed to their book values). Mark to market aims to provide a realistic appraisal of an institution’s or company’s current financial situation based on current market conditions.

Used to evaluate the fair market value of. Suppose on a particular trading day, the value of the security rises. What is mark to market accounting method? However, it can also be used for assets that are not associated with high degrees of fluctuation, such as business inventory and real estate. The goal of mark to market accounting is to provide a more accurate view of an organization’s financial position by using available prices in the open market.

In that case, the trader taking a long position. Mark to market accounting was an alternative to the popular historical cost accounting methodology, where an asset’s cost was evaluated based on its original price. All open positions are priced as if they were sold on the last trading day of the year (marked to market) and then “bought back” at the same price on the 1st trading day in january.

Mark to market involves adjusting the value of an asset to a value as determined by current market conditions. ✓ Mark To Market Accounting. The mark to market method has the effect of converting capital gains and losses into ordinary gains and losses. However, it can also be used for assets that are not associated with high degrees of fluctuation, such as business inventory and real estate. It estimates how much an asset might sell for if the owner sells it today.

✓ Mark To Market Accounting

Your unrealized gain or loss is then recorded. Mark to market involves adjusting the value of an asset to a value as determined by current market conditions. The goal of mark to market accounting is to provide a more accurate view of an organization’s financial position by using available prices in the open market.

It is the process of recording the current market value of an asset on the balance sheet. Used to evaluate the fair market value of. Marking to market (mtm) means valuing the security at the current trading price.

Therefore, it results in the traders’ daily settlement of profits and losses due to the changes in its market value. What is mark to market accounting method? In other words, “mark to market” or “mtm” is:

Marking to market (mtm) means valuing the security at the current trading price. What is mark to market accounting method? The mark to market accounting journal entries accounting journal entries accounting entry is a summary of all the business transactions in the accounting books, including the debit & credit entry.

Mark to market (mtm) is a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities. It estimates how much an asset might sell for if the owner sells it today. Banks (and brokerage firms) that own mortgage backed securities have been required — since november 2007 — to use mark to market accounting on these securities.

Suppose on a particular trading day, the value of the security rises. It estimates how much an asset might sell for if the owner sells it today. Mark to market accounting reflects the true value in the balance sheet of financial institutions.

Report sales from investments on schedule d, not form 4797. It has 3 major types, i.e., transaction entry, adjusting entry, & closing entry. Suppose on a particular trading day, the value of the security rises.

Under Mtm Accounting, Assets Can Be Recorded On A Company’s Balance Sheet At Their Fair Market Value (As Opposed To Their Book Values).

Companies’ financial reports should be showcasing accounts priced appropriately. This method failed to provide the actual value of the asset in the current times as the information used was outdated and irrelevant to the current market scenario. The market value is based on what a company could receive for the asset if it was sold at that point in time.. ✓ Mark To Market Accounting

Marking To Market (Mtm) Means Valuing The Security At The Current Trading Price.

In other words, “mark to market” or “mtm” is: With mtm, companies can also list. Coincidentally, this was just around the time these mortgage securities started dropping precipitously in value.. ✓ Mark To Market Accounting

The Goal Of Mark To Market Accounting Is To Provide A More Accurate View Of An Organization’s Financial Position By Using Available Prices In The Open Market.

Mark to market accounting reflects the true value in the balance sheet of financial institutions. Hence the method is not acceptable by many of the countries. Therefore, it results in the traders’ daily settlement of profits and losses due to the changes in its market value.. ✓ Mark To Market Accounting

In Fields Of Future Trading, It Minimizes The Administrative Overhead Of The Exchange.

This type of accounting is mainly used for securities and derivatives. At the end of the fiscal year, a company’s balance sheet must reflect the current market value of certain accounts. Report sales from investments on schedule d, not form 4797.. ✓ Mark To Market Accounting

The Mark To Market Method Has The Effect Of Converting Capital Gains And Losses Into Ordinary Gains And Losses.

Suppose on a particular trading day, the value of the security rises. It is the process of recording the current market value of an asset on the balance sheet. Mark to market (mtm) is a method of measuring the fair value of accounts that can fluctuate over time, such as assets and liabilities.. ✓ Mark To Market Accounting

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar